FrankJScott

#¤anarchiste+AnTi SarKo=SERIAL POSTEUR¤#

Inscrit le: 25 Aoû 2022

Messages: 1147

Localisation: Forex Trading

|

Posté le: Mar Jan 31, 2023 5:50 pm Sujet du message: New Reasons For Selecting Crypto Trading Posté le: Mar Jan 31, 2023 5:50 pm Sujet du message: New Reasons For Selecting Crypto Trading |

|

|

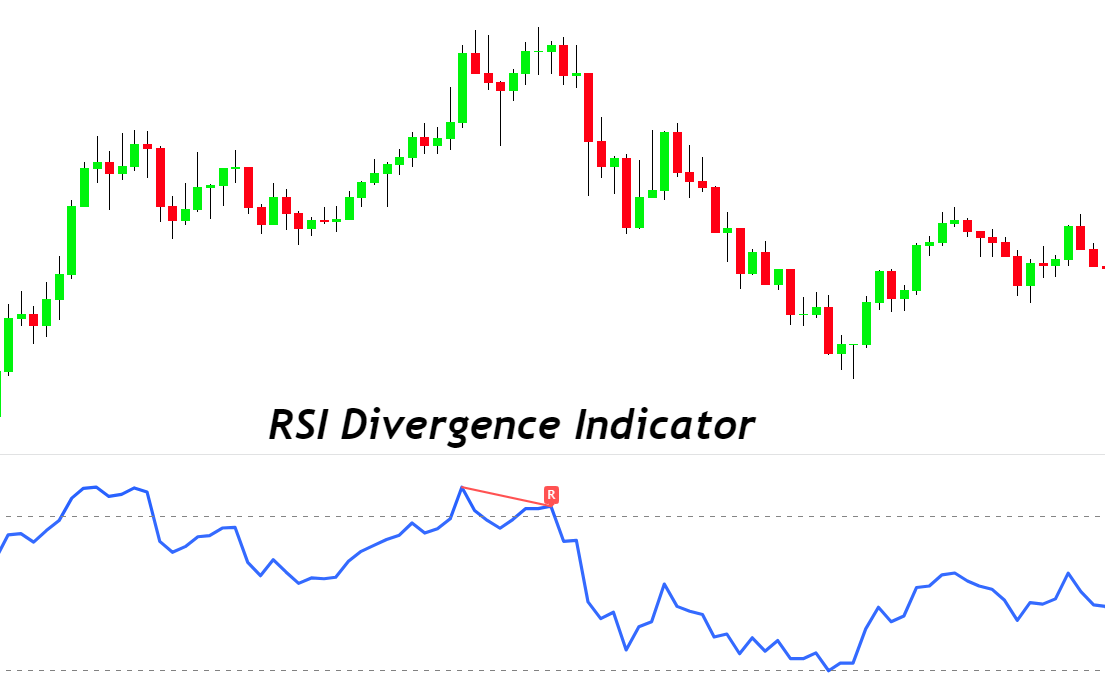

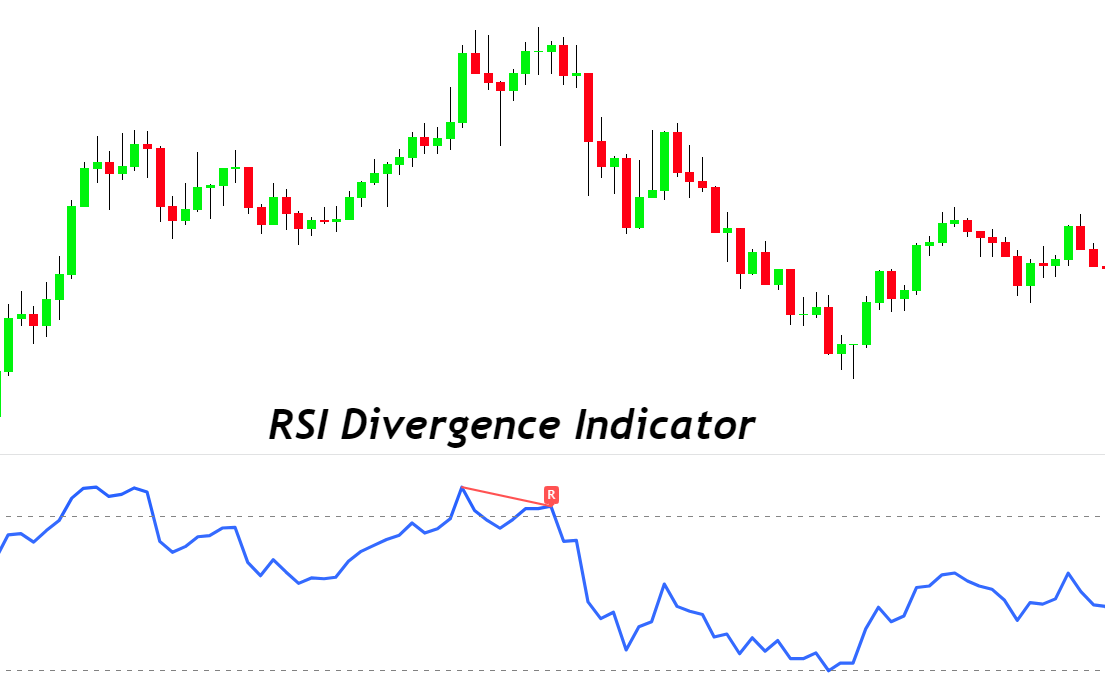

What Are The Factors To Know About Rsi Divergence

Definition: RSI diversence is a technique used for technical analysis to compare the direction of an asset's price movement as well as the direction of the relative strength indexes (RSI). Types There are two kinds of RSI divergence, regular divergence or hidden divergence.

Signal: Positive RSI divergence is an upward signal. Negative RSI divergence is a bearish signal.

Trend Reversal : RSI divergence may indicate an upcoming trend reverse.

Confirmation: RSI divergence can be used as a confirmation tool along with other methods of analysis.

Timeframe: RSI divergence may be examined at different time intervals to gain insights.

Overbought/Oversold: RSI values over 70 indicate overbought conditions, and values lower than 30 indicate oversold conditions.

Interpretation: To understand RSI divergence accurately requires considering additional fundamental or technical aspects. Read the best backtesting trading strategies for website tips including trading divergences, divergence trading, automated trading bot, divergence trading forex, backtesting, crypto trading, online trading platform, cryptocurrency trading bot, automated forex trading, divergence trading forex and more.

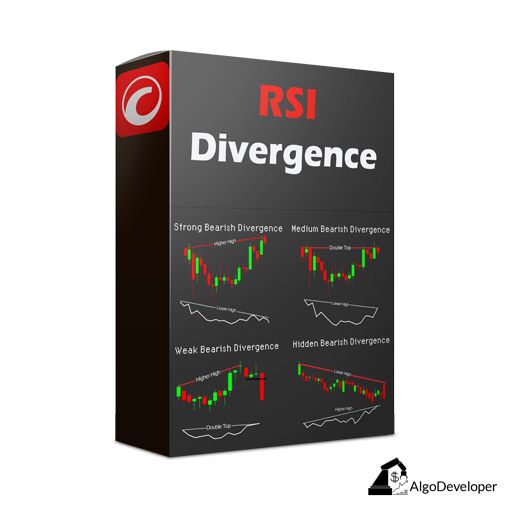

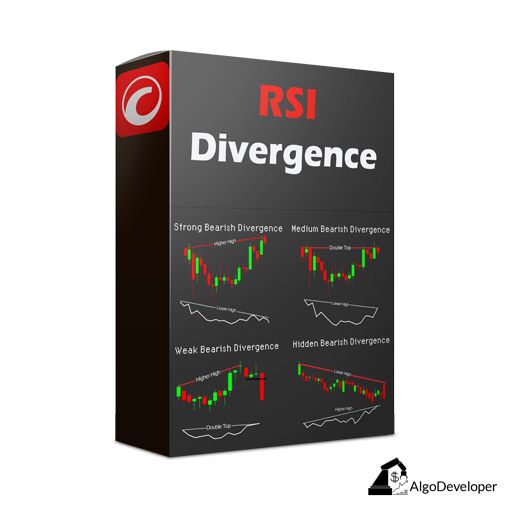

What Is The Difference Of Regular Divergence And Hidden Divergence?

Regular Divergence: When an asset's price is higher at its top or lower bottom, however the RSI makes a lower peak or lower bottom, it's referred to as regular divergence. It could indicate a possible trend reversal, however it is important to consider the other factors that are fundamental and technical to provide confirmation.Hidden Divergence: Hidden divergence happens when an asset's price makes a lower high or a higher low and the RSI creates a higher high or lower low. It is considered a weaker indicator than normal divergence but it can still indicate a potential trend reverse.

The technical factors to be considered:

Trend lines and support/resistance indexes

Volume levels

Moving averages

Other oscillators and technical indicators as well as other oscillators

The following are the essential elements to be aware of:

Releases of economic data

Details specific to your company

Market sentiment and mood indicators

Market impact and global events

Before you make investment decisions solely based on RSI divergence signals it's important to look at both the technical and fundamental factors. Follow the top rated automated cryptocurrency trading for website info including automated forex trading, automated crypto trading, forex trading, best trading platform, cryptocurrency trading, divergence trading, backtesting platform, best trading platform, automated trading bot, forex backtesting software free and more.

What Are Strategies For Backtesting For Trading In Crypto?

Backtesting cryptocurrency trading strategies involves simulating trading strategies on previous data to evaluate the potential for their profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy Definition of the trading strategies which are being tested.

Simulation: You could use software to model how the trading strategy would be implemented by using historical data. This allows you to examine how your strategy has performed in the future.

Metrics: Measure the effectiveness of the strategy with metrics such as profitability, Sharpe ratio, drawdown, and other relevant measures.

Optimization: Tweak the parameters of the strategy, then run the simulation in order to optimize the strategy's performance.

Validation: To ensure that the strategy is dependable and avoid overfitting, verify the effectiveness of the strategy on data that is not part of sample.

Remember that past performance shouldn't be interpreted as an indicator of future performance. The results of backtesting aren't an assurance of future profits. Live trading also requires that you consider the effects of fluctuations in the market transactions fees, market volatility, and other aspects of the real world. Have a look at the best trading platforms for more examples including online trading platform, automated trading software, crypto trading, RSI divergence, RSI divergence cheat sheet, backtesting platform, divergence trading, backtesting trading strategies, trading with divergence, crypto trading bot and more.

What Is The Best Way To Evaluate Forex Backtest Software For Trading Using Divergence?

When looking into forex backtesting software designed to trade with RSI diversgence, these are important factors to consider Accuracy of data: Make sure that the program has access to easy to historical and correct data regarding the currencies being traded.

Flexibility: The software must permit customizing and testing different RSI trading strategies.

Metrics: The software must offer a range of metrics to evaluate the performance of RSI diversity trading strategies. They include risk/reward ratios, profitability and drawdown.

Speed: Software must be efficient and fast so that multiple strategies can be backtested quickly.

User-Friendliness: Even for those with no knowledge of technical analysis, the software should be simple to learn and use.

Cost: You need to take a look at the cost of the program to determine if it is within your financial budget.

Support: The software needs to offer excellent customer support including tutorials, technical assistance as well as other assistance.

Integration: The software should integrate with other trading tools such as charting software , or trading platforms.

In order to ensure that the software will meet your requirements, and you are comfortable using it, you should try it out first with a demo account. Read the best best trading platform for more advice including trading platform crypto, divergence trading, best crypto trading platform, automated trading bot, crypto trading backtesting, forex backtesting software, trading with divergence, crypto trading, best trading platform, forex tester and more.

What Is The Way That Cryptocurrency Trading Robots Function In Automated Trade Software?

By following a set established rules, crypto trading robots perform trades on behalf of the user. This is how they work. Trading Strategy: The client creates the trading strategy, which includes the rules for entry and exit, the size of the position as well as risk management guidelines and risk management.

Integration Through APIs the trading bot is able to be connected to cryptocurrency exchanges. This allows it to access real time market data and then execute trades.

Algorithms: The bot utilizes algorithms to analyse market data and take decisions based on a trading strategy.

Execution. Without the need to manually intervene the robot executes trades according to the rules set out in the strategies for trading.

Monitoring: The bot continually examines the market's activity and makes any necessary adjustments to strategies for trading.

Bots for trading in cryptocurrency can be beneficial for the execution of repetitive or complex trading strategies, decreasing the requirement for manual intervention and allowing the user to benefit from market opportunities 24/7. Automated trading is not without risk. There is the possibility of security vulnerabilities as well as software mistakes. There is also the risk of losing control over your trading choices. Before you can begin trading on the market, you must be sure to thoroughly test and assess the trading bot. |

|