FrankJScott

#¤anarchiste+AnTi SarKo=SERIAL POSTEUR¤#

Inscrit le: 25 Aoû 2022

Messages: 1147

Localisation: Forex Trading

|

Posté le: Dim Fév 12, 2023 5:43 am Sujet du message: Free Hints For Choosing Crypto Trading Posté le: Dim Fév 12, 2023 5:43 am Sujet du message: Free Hints For Choosing Crypto Trading |

|

|

How To Choose A Good Starter Platform To Avoid The Risk Of Emotional Investment When Investing Into Cryptocurrency

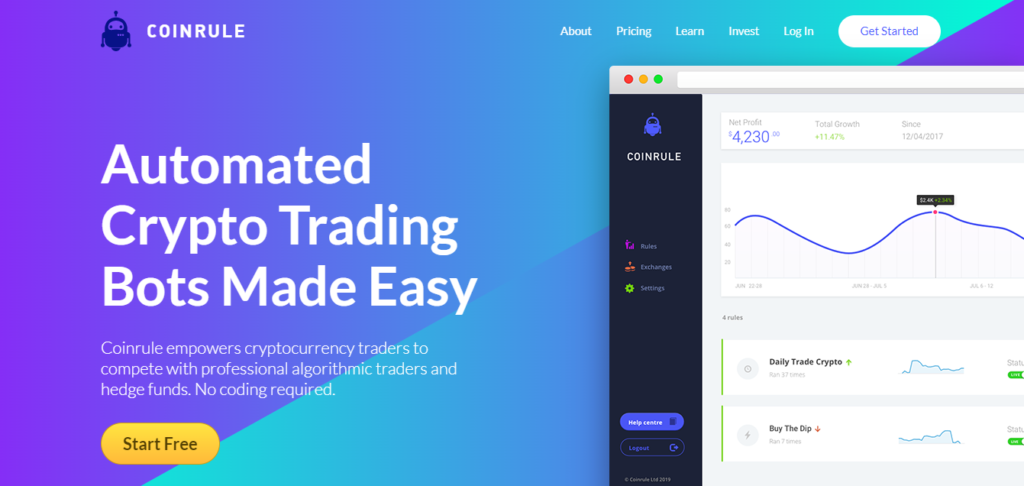

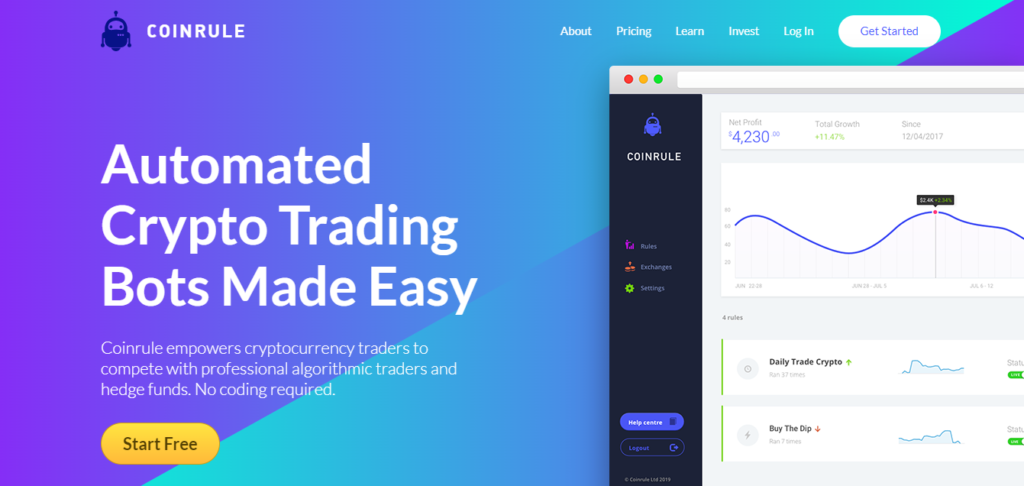

It can be volatile and emotionally charged to invest in cryptocurrency. Therefore, it is essential to select a platform that matches your investment goals and avoids making emotional decisions. Here are some guidelines to choose a suitable start platform. SecurityThe platform must have robust security measures in place to protect assets such as two-factor authentication and encryption, as well as secure storage of private keys.

A user-friendly interfaceThe platform must provide a user-friendly interface that is easy to navigate and understand in order to keep an eye on your investments and make informed decisions.

Reputation: Choose an online platform with an excellent reputation within the industry and also read online reviews and forum posts to learn more about the reputation of the platform.

Cost- Comparison of the fees and charges of different platforms to determine which gives the best price for the money.

Customer support- Search for a platform that offers excellent customer support, so you can get help quickly and easily should you require assistance.

Portfolio management and tracking tools Select a platform that offers strong portfolio tracking, management tools, and you will be able to easily monitor your investments and make an decisions based on information.

Regulation - A platform should be controlled in order to ensure your investments are secure.

You can make the best option for your portfolio by following these guidelines. Have a look at the top free trading bot for site tips including crypto trading bot, algo trading, automated trading system, algorithmic trading software, algorithmic trading software, trading psychology, forex tester, crypto futures, rsi divergence cheat sheet, cryptocurrency trading bots and more.

What Can You Do To Recognize Your Emotions To Stay Clear Of Emotional Investment When Investing In Crypto

Investing in crypto can be volatile and emotionally charged. It is crucial to be aware of your emotions to ensure you don't make choices in a way that is based on them. Here are a few tips to help you understand your emotions when investing in cryptocurrency. Recognize your emotional triggersLearn what triggers your emotions to make your decisions to invest and work to avoid situations that trigger those emotions. For instance, you could be more likely to take unintentional decisions when you're overwhelmed or anxious.

Reconsider your position. If you're feeling overwhelmed or emotionally stricken, take a step back and take some time to contemplate your options. Consider consulting a friend, financial advisor, or trusted colleague.

Keep a log - By keeping a log of your investment decisions, and the emotions they evoke You can spot patterns and make well-informed choices for the future.

It is possible to practice mindfulness. even during volatile markets, meditation and deep breathing will help you remain at peace and focused.

Be updated. Learn as much as you can about the cryptocurrency market, the assets that you're thinking of investing in to make informed choices.

Knowing and managing your emotions can allow you to avoid making impulsive decisions and make informed investments in cryptocurrency. Take a look at the most popular best crypto indicator for blog examples including crypto backtest, backtesting trading strategies, algo trading software, best crypto trading bot, how does trading bots work, cryptocurrency backtesting platform, algorithmic trading, trading indicators, backtester, best crypto indicators and more.

How To Focus On Strategies For The Long Term And Avoid Emotional Investments In Crypto Investment

The importance of focusing on long-term strategies is the best way to avoid emotional investing when you invest in cryptocurrency. These tips will help you achieve that target. A specific investment goal will help you keep your eyes on the long term.

Diversify your portfolio- Diversifying your portfolio can assist you in managing risk and reduce the impact of any single investment on your overall portfolio.

Avoid trading timing. Timing in the market can be frustrating, emotional and difficult. Instead, concentrate on a long-term approach and invest in a broad variety of assets.

Stay true to your strategy Once you have a clear objective for investing and a diverse portfolio, you must adhere to your plan, even when the market is unstable. Avoid investing in impulsive ways based on market movements.

Be informed - Keep yourself informed about the market for cryptocurrency and the investment options you're considering But avoid thinking too much and analyzing your investments too much. Keep to your long-term approach and believe that it will work over the long haul.

You can avoid making emotional investment decisions and invest in crypto with a focus on the long-term. Read the most popular best trading bot for binance for site recommendations including algorithmic trading platform, trading platforms, crypto backtest, algorithmic trading, stop loss and take profit, best trading bot for binance, crypto backtesting platform, trading psychology, backtesting trading strategies, crypto futures trading and more.

How To Invest What You Can Afford. Avoid Emotional Investment When Investing Crypto

To avoid emotional investment when you invest in cryptocurrency, it's essential to o y invest the amount you are able to lose. Here are a few suggestions to help you achieve that: Create an amount of money- Determine the amount of money you're comfortable investing and stick to your budget. It is best not to invest more than you're able to afford. y invest the amount you are able to lose. Here are a few suggestions to help you achieve that: Create an amount of money- Determine the amount of money you're comfortable investing and stick to your budget. It is best not to invest more than you're able to afford.

Avoid investing with borrowed money can increase the pressure to make profits, which could cause emotional decisions to invest. Stay within your budget, and o y invest in what's within your budget. y invest in what's within your budget.

Don't let emotions influence your investment decisions. It's easy to get caught up with the excitement of the market and make quick decisions. Don't lose sight of your investment objectives and put aside decisions based on the emotions.

Diversify your portfolio - Diversifying your portfolio will assist you in reducing risk and minimize the impact of one investment on your entire portfolio.

Do not chase returns. Don't invest in assets simply because they're doing well or because you're seeing everyone else investing in them. Stay true to your investment plan. Don't let the fear of losing out steer your decisions.

It is possible to stay clear of investing in investments with emotional motives that can result in financial losses. Instead, invest o y what you are able to afford and stick to a strategy which aligns with your goals. y what you are able to afford and stick to a strategy which aligns with your goals.

_________________

Google it! |

|

y invest the amount you are able to lose. Here are a few suggestions to help you achieve that: Create an amount of money- Determine the amount of money you're comfortable investing and stick to your budget. It is best not to invest more than you're able to afford.

y invest the amount you are able to lose. Here are a few suggestions to help you achieve that: Create an amount of money- Determine the amount of money you're comfortable investing and stick to your budget. It is best not to invest more than you're able to afford.